The recent decision by the U.S. Securities and Exchange Commission (SEC) to approve 10 spot Bitcoin Exchange-Traded Funds (ETFs) marks a significant milestone in the digital asset world. This move not only legitimizes Bitcoin as a tradable financial instrument but also has far-reaching implications for the Web3 space. In this article, we’ll explore what a Bitcoin ETF is, its potential impacts, and why this development is so important for investors and enthusiasts in the world of Web3 domains.

What is a Bitcoin ETF?

A Bitcoin ETF is a type of investment fund that tracks the price of Bitcoin. It allows investors to buy shares of the ETF on traditional stock markets. This provides a more accessible avenue for investing in Bitcoin without the complexities and risks associated with direct cryptocurrency ownership, such as managing wallets and keys. ETFs offer a regulated, transparent, and potentially less volatile way to invest in Bitcoin.

Why Is The SEC’s Approval a Big Deal?

The SEC’s approval of 10 spot Bitcoin ETFs is a game-changer. Previously, the SEC had been hesitant to approve such products, citing concerns over market manipulation and investor protection. However, this recent approval indicates a shift in regulatory attitudes towards cryptocurrencies. It recognizes their growing importance as a legitimate asset class.

What Is The Impact on the Web3 Domaining Space?

The impact of Bitcoin ETFs on the Web3 space is likely to be significant. With this approval, institutional investors and traditional finance companies now have a regulated and secure way to invest in Bitcoin. Here are a few ways we believe this development could impact the Web3 domaining space:

- Increased Legitimacy and Investor Confidence. The SEC’s approval adds a layer of legitimacy to Bitcoin, which will hopefully boost investor confidence. This is likely to spill over into the Web3 domaining space, as more investors see the potential in digital assets. This includes domain names associated with blockchain and cryptocurrency technologies.

- Greater Market Liquidity. The introduction of Bitcoin ETFs could lead to increased liquidity in the cryptocurrency market. This liquidity is beneficial for the Web3 domaining space, as it can lead to more capital flowing into various blockchain-based projects and assets, including domain names.

- Better Accessibility for Mainstream Investors. Bitcoin ETFs make it easier for mainstream investors to gain exposure to the cryptocurrency market. As these investors enter the space, they’ll come with an interest in related assets, including Web3 domains, expanding the market.

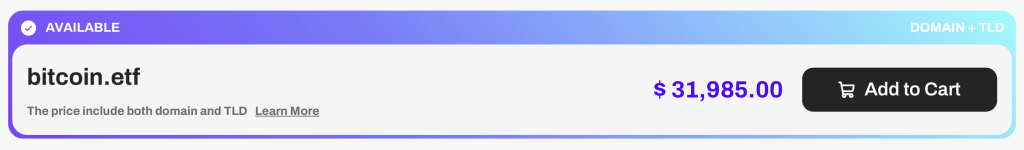

- Potential for Increased Domain Valuations. With more institutional and mainstream investors entering the crypto market, there is a possibility of increased demand for Web3 domains. This could lead to higher valuations for these digital assets, making them an even more attractive investment opportunity than before.

Bitcoin ETFs – A Catalyst for Web3 Domaining Growth?

The SEC’s decision to approve Bitcoin ETFs is a watershed moment, signaling a maturing market and regulatory environment for cryptocurrencies. For the Web3 domaining space, this development might lead to greater legitimacy and subsequently, increased investment. More investors entering the space could mean a larger pool of potential Web3 domain name buyers and drive up value. So, watch this space!